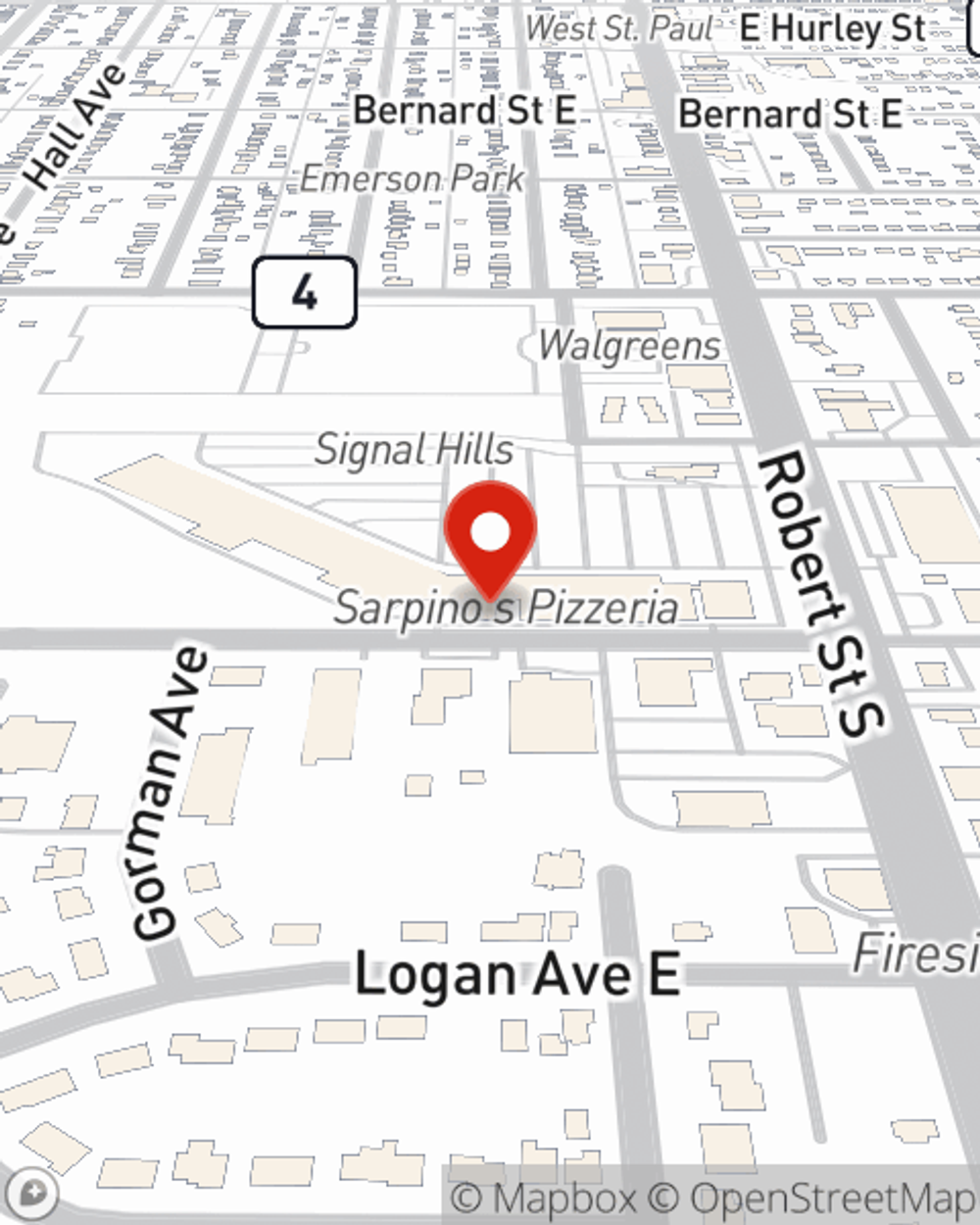

Insurance in and around West Saint Paul

Great insurance with your good neighbor

Cover what's most important

Would you like to create a personalized quote?

Be Ready For The Unexpected With Your Own Personal Price Plan®

Life is often unpredictable. We understand your need to help protect what matters most. With State Farm insurance, you can design a Personalized Price Plan® that's right for you, your loved ones, and the life you've built. Contact agent Sonja Lhotka to learn more about safe driving rewards, and bundling options and discounts.

Great insurance with your good neighbor

Cover what's most important

We’re There When You Need Us Most

As the largest insurer of automobiles and homes in the U.S., State Farm is equipped and experienced when it comes to helping you protect the life you've built with excellent service, competitive prices and outstanding coverage options.

Simple Insights®

Consider purchasing pet insurance

Consider purchasing pet insurance

Pets are members of the family. Consider purchasing pet insurance to help protect your pet against the unexpected!

Volcano safety tips

Volcano safety tips

Get natural disaster preparedness with our volcano safety tips. By taking these precautions, you can help protect your home and family from a volcano.

Sonja Lhotka

State Farm® Insurance AgentSimple Insights®

Consider purchasing pet insurance

Consider purchasing pet insurance

Pets are members of the family. Consider purchasing pet insurance to help protect your pet against the unexpected!

Volcano safety tips

Volcano safety tips

Get natural disaster preparedness with our volcano safety tips. By taking these precautions, you can help protect your home and family from a volcano.